Resilient, diverging, evolving: What Q1 results say about listed real estate

by David Moreno CFA, Indexes Manager

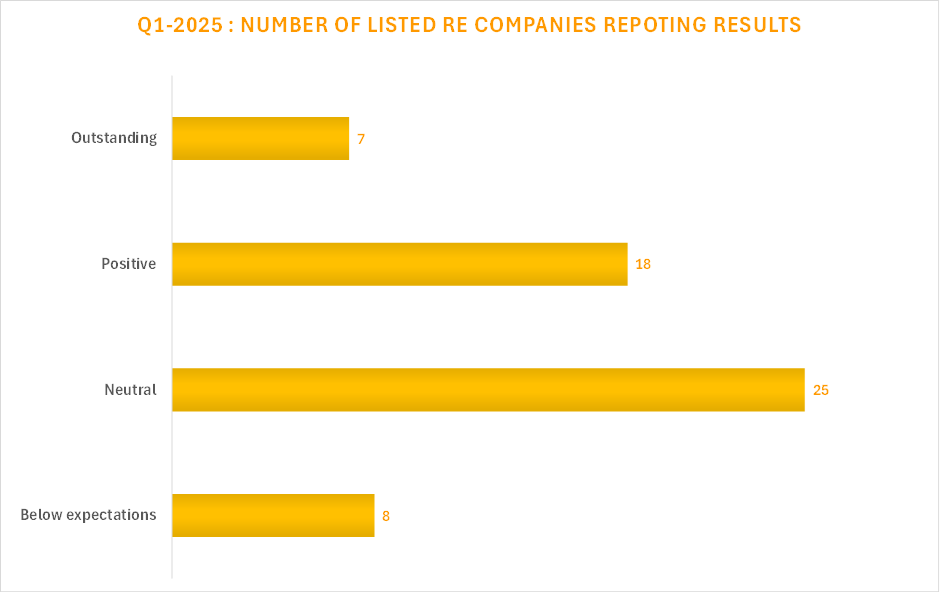

As another quarter wraps up, the latest reporting season reveals interesting trends and dynamics across listed real estate. The Q1 2025 season points to general positive dynamics for most companies in the industry during the reported period (FY2024 or HY 24/25), together with some divergence in performance across property sectors and geographies. By analysing a total of 58 companies, we have categorized them into four outcome groups: Outstanding, Positive, Neutral, and Below expectations. These categories reflect the general tone of the results based on earnings and NAV, rental growth, vacancy rates, property valuations, and leverage. Here's a look at the key trends shaping the European listed property landscape.

Source: EPRA research

Outstanding results (7 companies): Above expectations with strong dynamics

Companies in the "Outstanding" category, including names like Pandox, WDP, Home Invest, and Merlin Properties, showed strength/improvement across all five trend dimensions. Earnings grew robustly, with many reporting double-digit increases in EPRA EPS or FFO. Dividend growth was positive, and EPRA EPS and NTA growth ranged from +5% to +16%.

Rental growth remained solid (LFL growth around 4%), driven by indexation, lease renegotiations, and portfolio expansion. Vacancy levels were extremely low—typically below 5%—with some industrial and residential players achieving near full occupancy. Portfolio valuations were positive, even among some companies’ yields that rose modestly, and most companies plan to continue their expansion plans in 2025.

LTVs remained healthy—stable or slightly declining—ranging from 28% (Merlin) to around 48% (VGP). The cost of debt is creeping up for some (e.g., CTP: 3.09% from 1.95%) but largely mitigated by hedging.

Positive (18 companies): Broad Momentum

Companies with "Positive" results also demonstrated solid performance, although closer to market consensus and slightly more mixed signals. Most showed earnings and NAV growth (EPRA NTA generally rose between +1% and +9%), often in line with or slightly ahead of consensus. Nearly all companies reported YoY EPS increases, with dividend growth ranging from +1% to +13%.

Rental growth trends were constructive (LFL growth ranged from +3% to +8%), particularly in logistics, student housing, and self-storage. Occupancy rates were solid, mostly between 96–98%, with improvements in several portfolios (e.g., Wereldhave, Klepierre) and just a few companies flagging temporary declines in occupancy. Footfall and tenant sales are rebounding steadily in retail.

Portfolio valuations were generally stable or slightly up, supported by strong rental income, even as yields in some geographies edged higher. Leverage remains healthy, although a few companies flagged rising interest costs or modest increases in LTVs.

Neutral (25 companies): Aligned with market consensus and mixed signals

The "Neutral" group featured companies that delivered in-line results but lacked clear positive or negative momentum. Earnings were often flat or modestly up, while NAV performance varied and dividend policies were largely unchanged, with some exceptions like URW, which delivered a 9.4% beat vs. consensus.

Rental growth was mostly positive but not particularly strong, ranging between +2% and +6%. Vacancy trends diverged: while some reported stable metrics, others noted rising vacancies in office or self-storage segments.

Property valuations largely stabilized after prior declines, with modest LfL uplifts in a few cases (+0.5% to 3%). However, yield pressure remains a concern. Most companies are actively managing leverage down, and the cost of debt is gradually rising, though hedging ratios are important.

Below expectations (8 companies): Pressure points emerge

A small group of companies reported results "Below Expectations," marked by earnings declines, dividend cuts, and NAV declines. These firms typically faced a combination of increasing cost of debt, rising vacancy, and downward asset revaluations, although they continue to improve their debt profile.

There was some certain distribution in rental growth (-1.4% to 5%) and vacancy (8.5% to 15.3%). Portfolio valuations fell further, particularly for repositioning assets or in non-core geographies.

Finally, companies continue to work hard on managing leverage.. LTV ranges from 25% to 49%, with a few trending lower YoY. Average cost of debt remains low (1.4–2%) in most cases, but the upward trend is expected to continue in 2025.

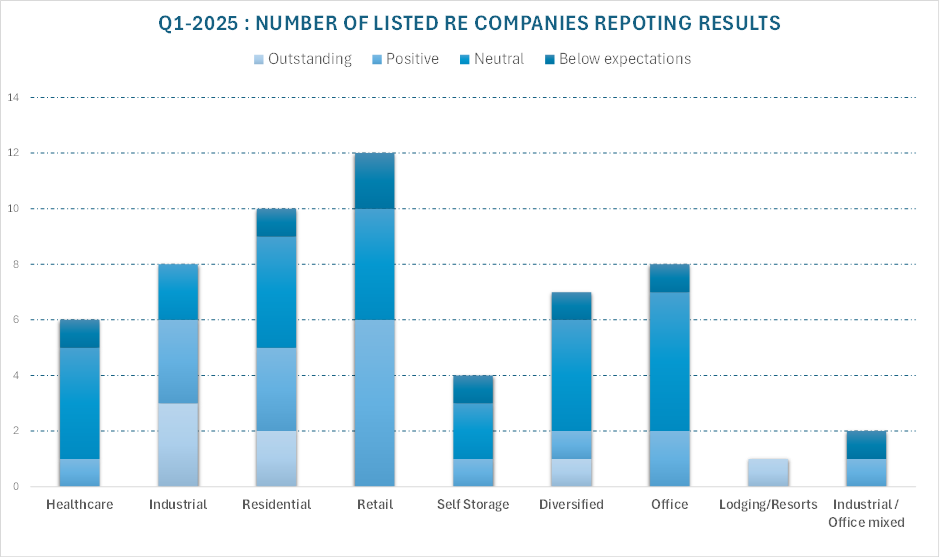

Sector dynamics

Industrial and logistics companies led the pack, with robust rental growth, near-full occupancy, and disciplined expansion driving strong results. Residential companies showed mixed performance—stable in some markets but pressured in others by rising vacancy and limited reversion. Retail operators saw gradual improvement in footfall and tenant sales, especially in dominant urban centres, though results varied based on geography. Office landlords still faced tough conditions, with elevated vacancy and valuation declines, although showing positive improvement in some operational metrics. Meanwhile, specialized sectors like hotels & lodging, self-storage and student housing remained resilient, supported by indexation and strong demand fundamentals.

Source: EPRA research

Key takeaway: Divergence, optimism, and proactive management

While divergence defines the landscape, the overall sentiment is optimistic. Many companies are gaining positive momentum into 2024–2025, while others are steadily improving key metrics—even as they continue to navigate a challenging environment. As the macro environment continues to normalize, the ability to deliver strong earnings, dividends growth, and preserve NAV will remain crucial, and proactive management will continue to pay off.