Emerging markets – evolution and opportunities

By Giovanni Curatolo, Research and Indexes Analyst

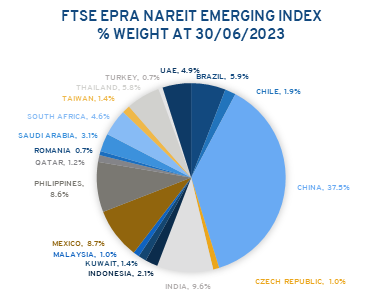

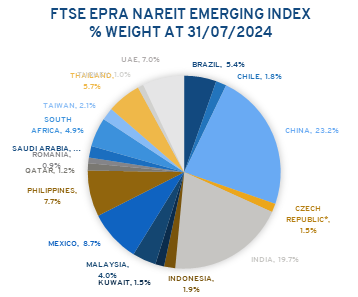

Though facing higher volatility and political uncertainty than developed markets, investing in emerging markets can provide geographic and sector diversification opportunities. The FEN Emerging Index has historically been heavily weighted toward Asia-Pacific countries. More recently, driven by macroeconomic shifts and growing interest in the broader listed real estate space, the index has become more geographically diverse, now representing 18 different countries. Notably, during the latest index review, the inclusion of S IMMO, a Pan-European property company primarily invested in Hungary, and the addition of the first Brazilian “fundo de investimento immobiliario”, are encouraging signals of the growing appetite for those markets.

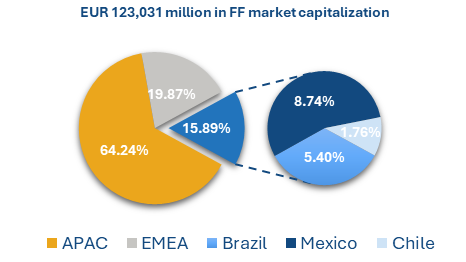

As of July 2024, the FEN Emerging index comprised of 128 constituents, with a total market cap. of EUR 123 billion, representing 7.20% of the FEN Global Index. Geographically, the weight of the Asia-Pacific region was down to 64.24% as of July 2024 (from 65.97% last year) while EMEA and Emerging Americas represented respectively 15.98% and 19.87% of the index.

Source: EPRA

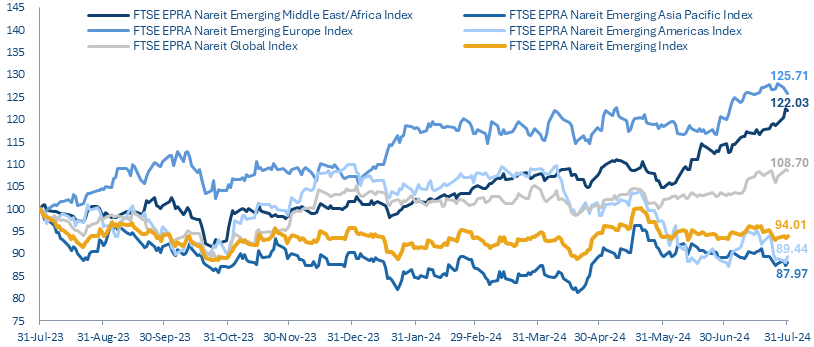

In terms of performance, the FEN Emerging Index posted a negative return of 5.99% year-on-year and 1.74% as of July 2024. The European and the broader EMEA indexes outperformed both the other emerging indexes and the overall global index, returning 25.71% and 22.03%, respectively.

1-Year TR performance of the FEN Emerging Indexes

Source: EPRA

Some of the rough year-on-year performance of the broader index can be attributed to China, which was strongly affected by the ongoing crisis of real estate developers and home builders, and to the two largest LATAM economies, Brazil and Mexico, whose performance was greatly impacted by currency depreciation against the EUR and a high-interest rate environment.

Two rather interesting cases, which are delved into in our newest Emerging Market Report, are Brazil and Greece. Both countries have undergone significant challenges in the last decade and have shown remarkable resilience and improvements in their macroeconomic environment. This has translated into new foreign investments and increased interest in the listed real estate sector.

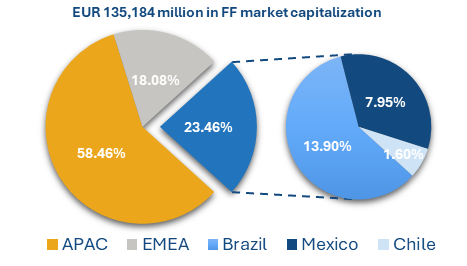

In Brazil, the broader universe of“fundos de investimento immobiliario (FIIs)”(Brazilian REITs), comprises 955 funds with a total market cap. of EUR 21 billion, of which 534 are listed in the local exchange. Albeit being quite diverse in terms of mandates and exposure, approximately 53 of them, with a total market cap. of EUR 12.2 billion, invest predominately in income-producing investment properties. The inclusion of these in the FEN Emerging Index could increase the market cap. of the index up to EUR 135.2 billion, simultaneously increasing the diversification benefits that investing in the index provides.

|

Current Emerging Index composition |

Projected Emerging Index composition |

|

|

|

Source: EPRA

In Greece, steady GDP growth over the past decade, combined with government reforms and increased efforts to stabilize the economy, has made the country attractive to foreign investment, thereby creating new opportunities for the listed real estate sector. This has translated into boosted confidence and new IPOs, bringing the number of listed real estate companies to 12, with a total market cap. of EUR 4.25 billion. Greece’s listed real estate market can certainly benefit from the improved economic stability, and the combination of increased foreign investment and improved operating performance could lead Greek listed real estate companies to grow further and overcome the current challenges to be included in the FEN Emerging Index.

To conclude, the evolving composition of the FEN Emerging Index highlights the ongoing transformation and flourishing investment potential in emerging markets, which may offer opportunities for diversification in the current dynamic macroeconomic environment.