The rise of Alternative Property sector

By David Moreno, CFA. Indexes Manager at EPRA

Historically, the European real estate industry has been dominated by four traditional property sectors: office, residential, retail, and industrial. However, during the last decade, the industry has undergone a notable shift away from these traditional core property sectors towards other alternatives, seeking more diversification, innovation, and growth.

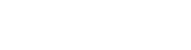

This movement began before the pandemic and accelerated afterwards, supported by some megatrends (Fig. 1) that are reshaping the European economy. Other property spaces like healthcare, self-storage, senior and student housing, and data centres are gaining attraction, becoming flagship opportunities for many REITs, property companies, and institutional investors.

Fig.1. Megatrends in the post-pandemic world boosting alternative RE sectors

Source: EPRA Research.

To better understand the performance and evolution of these alternative sectors, EPRA has created some in-house research benchmarks for each of these alternative sectors as well as a composite Alternatives Sectors benchmark.

Fig 2. Total Return: Alternative RE Sectors vs European Listed RE (Dec/14 – May/24)

Source: EPRA Research. *FSTE EPRA Nareit Developed Europe Index

Healthcare

Demographic projections over the long-term reveal that the EU is ‘turning increasingly grey’ in the coming decades. Eurostat projects a 4% decline in the total EU population from 449 million (2022) to 432 million (2070). Simultaneously the share of the elderly population will increase from 21.2% to 30.5% by 2070. In addition to demographic shifts, clinical and technological advances also contribute to increased healthcare spending.

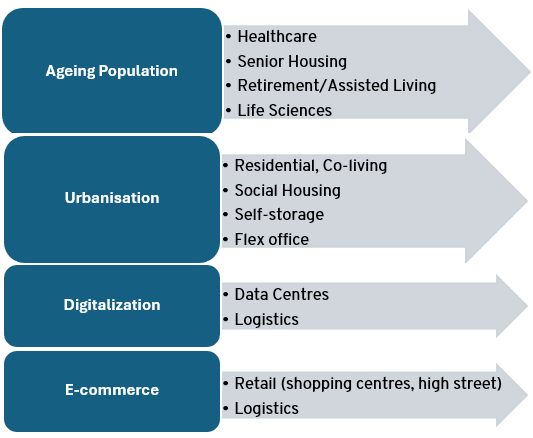

However, the availability of stock is one of the biggest barriers to sector expansion. According to the OECD, on average, the EU has approximately 46 beds in residential LTC facilities per 1,000 population aged 65 years and over, which clearly does not match the growing demand. Simultaneously, the growing demand for life science facilities and labs has boosted investments in this specific property type in many different geographies.

Fig.4. Beds in LTC facilities in Europe (per 1,000 population aged 65+)

Source: OECD Health Statistics (2023).

These elements support the case for rental growth and operational expansion for healthcare facilities in the European real estate market. EPRA identified seven listed REITs in the European healthcare sector, with a total market cap of EUR 9.2 billion as of March 2024, which has more than doubled in the last decade.

Alternative Housing

Residential properties have been part of the listed real estate industry in Europe for decades, although they became much more relevant after 2012 with the expansion of the German residential landlords and the emergence of several alternative subsectors like co-living, social housing, senior living, and purpose-built student accommodation (PBSA) in continental Europe.

During the last decade, the number of alternative housing specialists in Europe multiplied by four and their total market cap changed from EUR 1,403 million in 2014 to EUR 7,252 million in 2024, representing a total growth of 416.7% (CAGR 17.8%). Regarding long-term potential growth, some demographic trends can be highlighted. First, the provision of care homes and senior living facilities has not evolved fast enough. Simultaneously, looking at senior housing, most of the

European markets remain highly fragmented, mainly due to regulatory and idiosyncratic differences across several territories.

Fig.5. Number of Listed Alternative Housing Specialists in Europe

Source: EPRA Research.

Second, there is substantial evidence of an undersupply of student accommodation in most of the main cities in Europe. Third, several investors are eager to increase their allocations to this sector in the near future, although some important barriers need to be surpassed. Finally, ESG and sustainability are becoming the most important topics for all types of stakeholders, where REITs and property companies are growing in importance and becoming key participants in the sector.

Self Storage & Data Centres

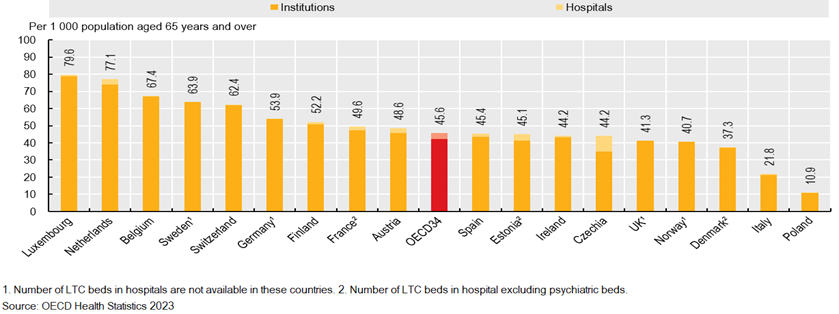

Self-storage companies are entities which rent units out to individuals and companies for a contractual minimum period, usually above 6 months, for the sake of storing their goods. As an industry, it has been fuelled by many drivers, including changes in consumers’ behaviour, household composition and digitalization, which have boosted the growth of this sector in recent years. The FTSE EPRA Nareit Developed Europe index currently counts 3 self-storage constituents and has proven to be resilient during economic downturns. In previous difficult periods in Europe, the sector managed to maintain strong results, outperforming not only listed real estate but also some other asset classes, reaching strong total returns during the COVID-19 pandemic (26.7%), Brexit (16.5%) and the Eurozone Crisis (11.4%) periods.

Fig .6: Self Storage performance during economic downturns

Source: EPRA Research

On the other hand, data centres are some of the rising stars in the real estate industry. The IT infrastructures at the core of the new “digital economy” are mainly stored in data centres, which are assets that allow efficient storage and management of large amounts of data. Despite looking like “conventional” warehouses, they are designed to provide high-level technological space in which companies, institutions and other organizations can allocate their computing resources. A large amount of the available space is leased out to tech giants which have been involved in cloud services and AI development. These heavy tech corporations3 have seen an incredible growth in market capitalization, reaching 23.87% of the S&P 500 as of March 29, 2024.

3 Google, Microsoft, Nvidia, Meta, Amazon, Oracle, Adobe.

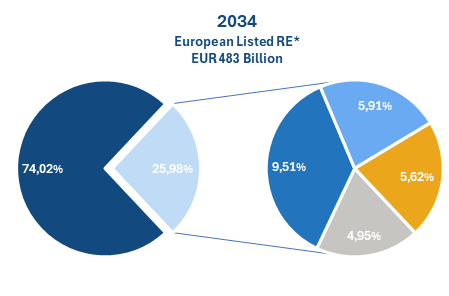

In terms of size, the largest data centres market in the world is the US, led by two listed giants. In the European listed arena, currently there are no listed specialists, however, some of the listed REITs are already investing in this type of properties. In Spain, Merlin Properties launched a new business line dedicated to data centres at the end of 2021, four already completed in Madrid, Barcelona, and Alava, with a total capacity of 60 MW. In the United Kingdom, SEGRO has also ventured into the data centre landscape by owning the land and the 'shells', but not operating them, instead, leasing them out to operators. Given the rising demand for data centres and the overall growth of the region, EPRA estimates a significant expansion of the sector that could reach EUR 46 billion in market capitalization by 2034, representing around 9.5% of the FTSE EPRA Nareit Developed Europe Index.

Alternative sector during the next decade

By considering the own fundamentals of each of these property sectors, as well as the historical trends of growth and diversification in the European listed real estate industry, EPRA estimates that the alternative property sectors could represent around 26% of the industry by 2034.

Fig .7: Potential estimated growth of alternative sectors in the Europe

|

|

|

Source: EPRA Research.

*FTSE EPRA Nareit Developed Europe Index

Check EPRA’s website for more details on our market research reports: